Shopify (NYSE: SHOP) is a leading e-commerce platform that allows businesses to create online stores and sell products online. It has been one of the fastest-growing companies in recent years, and its stock has also been a top-performing investment. This article will take a closer look at Shopify’s growth potential and investment opportunity.

Overview of Shopify Shopify was founded in 2006 by Tobias Lütke, Scott Lake, and Daniel Weinand as an online snowboard store. However, they soon realized that there was a need for an easy-to-use e-commerce platform for small businesses, and thus, Shopify was born. Today, Shopify is a leading e-commerce platform that enables businesses to create online stores and sell products online.

Shopify’s revenue has been growing at a fast pace, with a revenue growth rate of 86% YoY in Q4 2020. Its revenue for the full year 2020 was $2.9 billion, up from $1.6 billion in 2019. This growth has been driven by an increase in the number of merchants on its platform, as well as an increase in the average revenue per merchant.

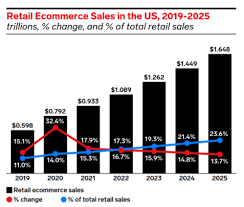

Shopify’s Growth Potential Shopify’s growth potential is significant, as the e-commerce industry is still in its early stages. According to eMarketer, global e-commerce sales are expected to reach $6.38 trillion by 2024, up from $3.53 trillion in 2019. This growth is driven by the increasing number of consumers who prefer to shop online, especially during the COVID-19 pandemic.

Shopify’s growth potential is also driven by its expansion into new markets and the addition of new features to its platform. For example, Shopify has been expanding into international markets such as China, India, and Japan. It has also been adding new features to its platform, such as Shopify Payments, which allows merchants to accept payments directly on the Shopify platform, and Shopify Fulfillment, which allows merchants to outsource their order fulfillment to Shopify.

Shopify’s Competitive Advantage One of Shopify’s main competitive advantages is its easy-to-use platform. Shopify allows merchants to create online stores quickly and easily, without the need for any technical skills. This ease of use has made it attractive to small and medium-sized businesses that do not have the resources to build their own e-commerce platforms.

Another competitive advantage of Shopify is its ability to scale. Shopify can handle businesses of all sizes, from small online stores to large e-commerce businesses with millions of dollars in revenue. This scalability has made it attractive to larger businesses that need a platform that can grow with them.

Investment Opportunity Shopify’s stock has been one of the best-performing stocks in recent years, with a return of over 5,000% since its IPO in 2015. Despite its strong performance, many analysts believe that Shopify’s growth potential is still significant, and its stock is undervalued.

One reason why Shopify’s stock is undervalued is that the company has yet to turn a profit. However, this is not uncommon for fast-growing companies that are still in their growth phase. In fact, Shopify’s revenue growth rate and gross profit margin are higher than many of its peers in the e-commerce industry.

Another reason why Shopify’s stock is undervalued is that it is still a relatively small player in the e-commerce industry. Shopify’s market share in the e-commerce industry is only around 7%, compared to Amazon’s market share of around 38%. This means that there is still significant room for growth for Shopify.

Conclusion In conclusion, Shopify is a fast-growing e-commerce platform with significant growth potential. Its easy-to-use platform, scalability, and expansion into

49

Why Shopify Stock Continues to Soar: An Analysis

Shopify (NYSE: SHOP) is a leading Canadian e-commerce platform that provides businesses with a one-stop-shop solution for all their online selling needs. Since its inception in 2006, the company has grown rapidly, helping businesses of all sizes to build and manage their online stores. The company has experienced remarkable growth in recent years, and its stock price has soared as a result. In this article, we will examine the reasons why Shopify’s stock continues to rise, as well as its potential for future growth.

- Strong Financial Performance

One of the key reasons why Shopify’s stock has continued to rise is the company’s strong financial performance. In Q4 2020, Shopify reported revenue of $977.7 million, an increase of 94% compared to the same period in the previous year. The company’s gross merchandise volume (GMV) also grew by 99% year-over-year to $41.1 billion, and the number of merchants using the platform increased by 86% to 1.7 million. Shopify’s net income for the quarter was $123.9 million, up from $0.8 million in the same period in 2019.

- Continued Growth in the E-commerce Market

The COVID-19 pandemic has accelerated the growth of e-commerce, and Shopify has been a major beneficiary of this trend. As more businesses move online to reach customers who are staying home due to lockdowns and social distancing measures, demand for Shopify’s platform has increased significantly. In 2020, the company added over one million new merchants to its platform, as businesses sought to establish an online presence. With the shift towards e-commerce expected to continue, Shopify is well positioned to continue to grow in the years ahead.

- Innovative Products and Services

Shopify has built a reputation for being an innovative company that is always looking for new ways to help its merchants succeed. The company has introduced several new products and services in recent years, including Shopify Capital, which provides financing to small businesses, and Shopify Fulfillment Network, which helps businesses manage their inventory and fulfill orders more efficiently. The company has also invested heavily in research and development, with a focus on developing new technologies and tools to help merchants succeed in the highly competitive e-commerce market.

- Strong Brand and Customer Loyalty

Shopify has built a strong brand and a loyal customer base, which has helped it to grow rapidly in recent years. The company is known for providing excellent customer support, and its platform is highly regarded by merchants for its ease of use and versatility. The company’s focus on creating a positive customer experience has helped it to build a loyal customer base, which has been instrumental in driving its growth.

Conclusion

Shopify’s strong financial performance, continued growth in the e-commerce market, innovative products and services, and strong brand and customer loyalty are all contributing factors to the company’s success. As the e-commerce market continues to grow, Shopify is well positioned to benefit from this trend, and its stock price is likely to continue to rise in the years ahead. While there are risks associated with investing in any stock, Shopify’s impressive track record and future growth potential make it an attractive investment opportunity for investors looking to benefit from the growth of the e-commerce market